Welcome

I hope you are all keeping well at this very challenging time. One positive result from this disruption is that we are all keenly aware of the people supporting our basic existence who, if previously overlooked, are now at the forefront of our attention, respect and appreciation. Most people I have spoken to also think that it is a good thing that we have the time and space to reconsider our priorities in terms of how we spend our time and money. There seems to be a consensus that things will be different in the future and that it will be a positive change. Let’s hope it turns out like that.

The shutting down of the economy has done real damage to growth worldwide. Every country has acted slightly differently depending on its needs and values. We will not know for sure how the UK will proceed until Boris Johnston resumes his role. The leadership is refusing to discuss the future not just to be cautious but also to avoid committing him to any future strategy. We are behind other European countries in terms of opening up the economy but the progress they have made to date is actually not very significant.

Unprecedented Support

What has been impressive has been the international effort by governments of all countries to support business and households. In the Global Financial Crisis of 2008, the US considered deploying “Helicopter Money” but shied away from this course of action. Instead they focused their considerable financial resources toward increasing the capacity of banks to lend (Quantitative Easing). As I’m sure you remember, the UK and EU followed suit. The effect on markets was the inflation of all asset classes (equities, bonds and property). In this pandemic, by contrast, any reticence in 2008 has been cast aside and words such as ‘limitless’ have been used to reinforce the message of support. Fed chairman Jay Powell put it in no uncertain terms stating “We really are going to use our tools to do what we need to do here.” and “When it comes to lending, we are not going to run out of ammunition”. You will have seen in the news that US citizens are actually getting a cheque with the President’s name on it. The US Treasury is also taking over loans to businesses, a percentage of which, they are certain to suffer losses on (action considered a step too far in 2008). When the largest economy sets this kind of precedent it permits other economies to take similar action without concern for weakening their economy relative to others.

Stock markets are ignoring the very poor immediate news and instead are looking ahead to anticipate the speed at which our society will emerge to some kind of normality. Also, globally there is a willingness to accept the risk of inflation resulting from the new money being pumped into the global economy. This approach serves to place a floor under share prices resulting in greater potential for gains in the medium term. No longer are economists considering how great this depression could be, instead they are speculating if GDP will exceed 2019 figures by the end of 2021 or if it will take until 2022. The challenge will be for governments to judge how much inflation is tolerable in order to provide the necessary financial support its citizens will require. When the time comes, holding investments which rise with inflation will be of utmost importance.

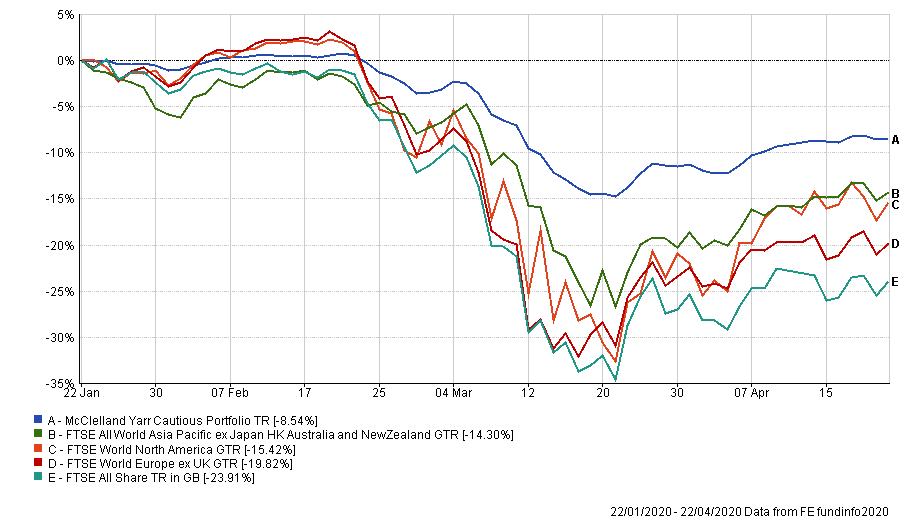

Chart – Relative Performance Of Global Equities (3 Months)

Across Asia, markets have been more resilient than western markets as their preparedness and swift action has paid economic dividends.

McClelland Yarr Portfolios

Based upon all of the above we believe our current investment strategy is best equipped to buffer any potential downside shocks without sacrificing reasonable participation in the eventual recovery. The management costs of the funds we have selected are among the most competitive in the market. This is an important factor in preserving the portfolio value should the recovery be delayed. In the long term, investments have always risen in value. While we recognise this to be true we also realise that most people are prepared to sacrifice some gain in the future to benefit from the avoidance of excessive losses. As a result we reaffirm our cautious investment approach in the current difficult conditions while remaining optimistic about the long term.

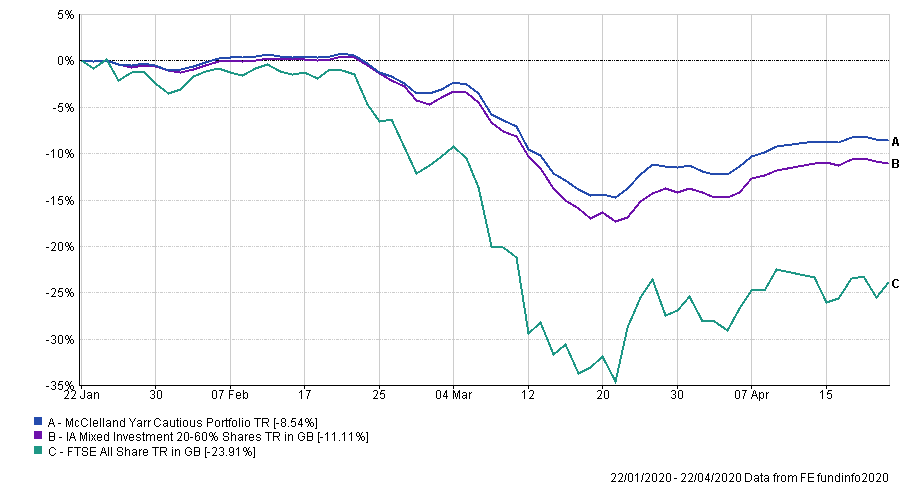

Chart – Relative Return Vs FTSE

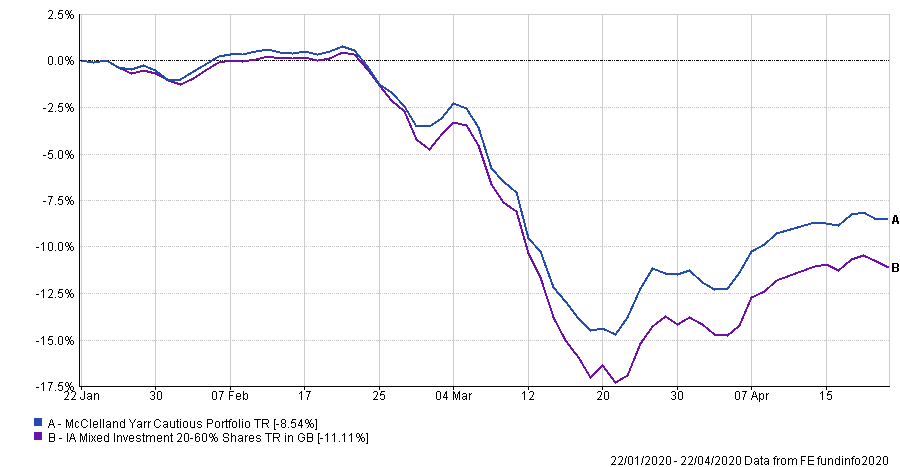

Chart – Relative Performance Vs Benchmark

Local Market

At a local level here in Northern Ireland it is important to remember that approximately 75% of our economy is made up of the public sector. This includes teachers, local government employees, civil servants and health workers among others. These people are better off than before the crisis as energy costs have fallen and some mortgage costs have fallen also. We should be less impacted compared to other parts of the UK where the public sector is smaller. This situation should be supportive to the housing market in NI relative to other regions in the UK.