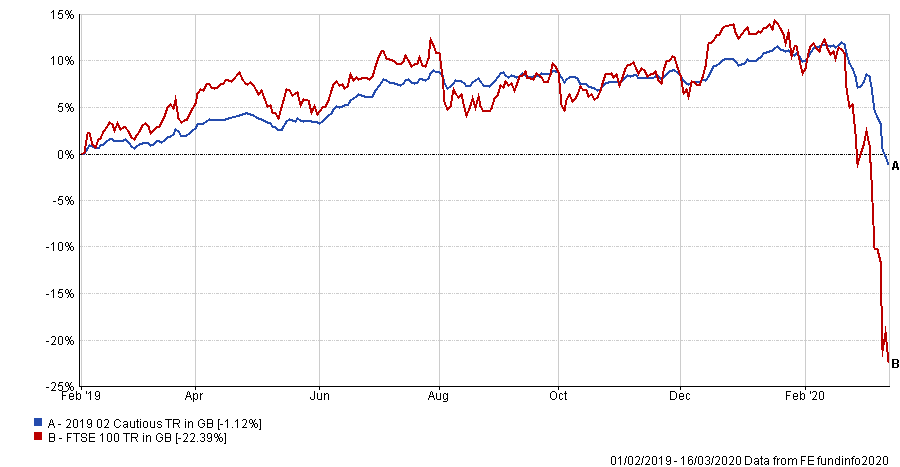

For more than thirty years we have invested our client’s money through the events of Black Monday (in which FTSE 100 fell by 27% over 12 days), the Dotcom bubble, the tragic events of 9/11 and war in Iraq (FTSE 100 fell by 48% over 27 months). During the Credit Crisis (index fell by 40% over 15 months) and now the Coronavirus which caused a fall of over 30% in one month. The lessons learned from the previous three market crashes informed the investment philosophy of our current portfolios which have withstood the majority of the fall over the past month. Since the start of the year, the FTSE 100 has fallen by over 30% compared with our cautious portfolio has fallen by 9.71% (less than a third of the fall in the stock market). By contrast, in 2019, the FTSE 100 rose by 17.32% compared with our cautious portfolio which achieved 13.04% (over two thirds of the rise in the stock market). The primary strategy in our cautious portfolio has been to mitigate the risks as far as possible without disproportionately sacrificing the growth prospects and I am pleased to say it is performing as designed.

The question on everyone’s mind in times like these is whether to stay invested or to withdraw their money. We can look at history to provide some guidance although it is not guaranteed to be repeated.

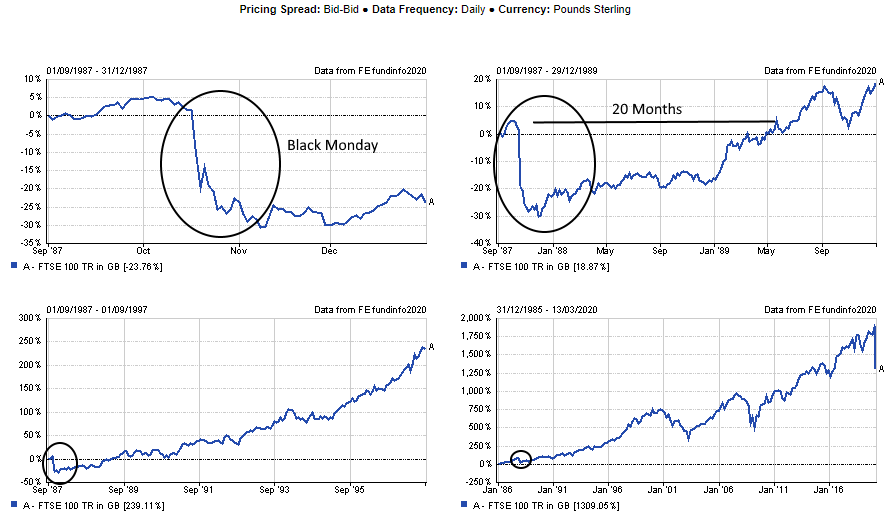

Black Monday

After the crash of Black Monday in 1987, it took 20 months until the market had recovered to the previous high. It then went on to grow by 239% over the following 8 years.

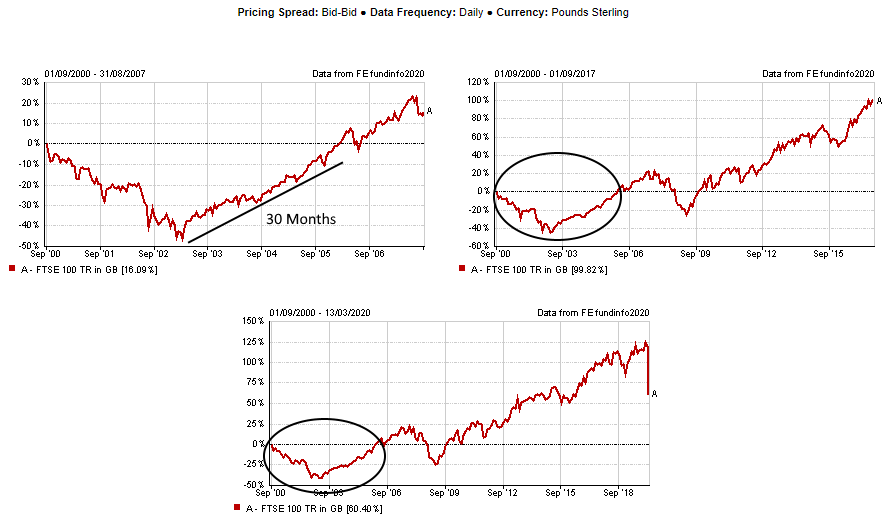

Dotcom Bubble (1999)

Markets had entered the end stages of a decade long bull run. They had begun to fall in value when the terrorist events of 9/11 took place. This precipitated a stock market crash. This crash was compounded by the Enron accounting scandal which shook investor confidence. Most people today have forgotten how this accounting scandal destroyed confidence in the accounting standards. The Enron scandal further devastated confidence in the technology companies which were so highly valued despite never having made a profit. Before the market recovered, the Iraq war began and the stock market fell to 3287. From the lowest point, it took 30 months to recover.

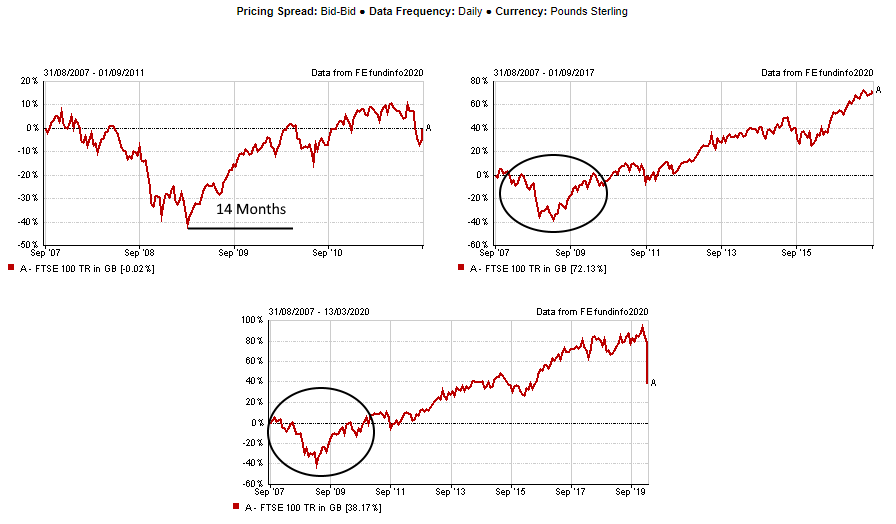

Banking Crisis

The Banking Crisis again saw trillions wiped off balance sheets and saw not just banks but countries become insolvent. It took just 14 months for the FTSE 100 to recover from the lowest point (3512). It continued on to rise by 72% over the next 7 years.

Coronavirus

In the history of the FTSE 100 only Black Monday has seen market falls as steep as last month. Our cautious portfolio is positioned to buffer our clients from the full impact of the falls while being able to participate to a larger extent in the recovery when it comes.

Conclusion

The key questions investors are faced with in every crash is this; how have the unfolding events changed the world we live in, who will survive and what will be of value. This is difficult to establish when markets are in turmoil and when human emotion combined with herd instinct are driving flows of money. This phenomenon causes some companies to be overvalued in the good times and when confidence has eroded it is normal to have an overreaction to the downside. Each market crash is caused by a unique set of circumstances leading to a fear that the economic result will be more devastating than previously experienced. For those of you old enough to remember the Iraq war, there was a genuine fear that Saddam Hussein could launch nuclear weapons. After 9/11 there was a fear that air travel would never be safe again and that society had changed forever. During the banking crisis many clients phoned the office worried about the safety of the money in their current account. I had it on good authority from a director of an international bank that we were days away from a complete banking meltdown. The only solution which could have saved the banks was government intervention which quickly happened.

These earlier crises were severe with no definite end in sight. The virus pandemic will eventually end by the discovery of a vaccine or by naturally acquired herd immunity. The uncertainty therefore is what damage will be caused in the meantime as we try to combat the worst effects of the virus. History teaches us that an existential crisis does eventually end and governments take the necessary action to allow economies to heal and to prosper once again.

Peter Yarr

Director