Investment Philosophy Principle 3 – Protect against losses before seeking returns (Part 1 – Risk)

Although that, historically, it has been true that all you need to recover losses is time, this is not always possible especially for those needing income. Therefore we analyse risk with a multi-factored approach and judge investment funds returns against these risks. The following charts show the relative risk levels of each fund within the portfolio from two of the main measures that we analyse.

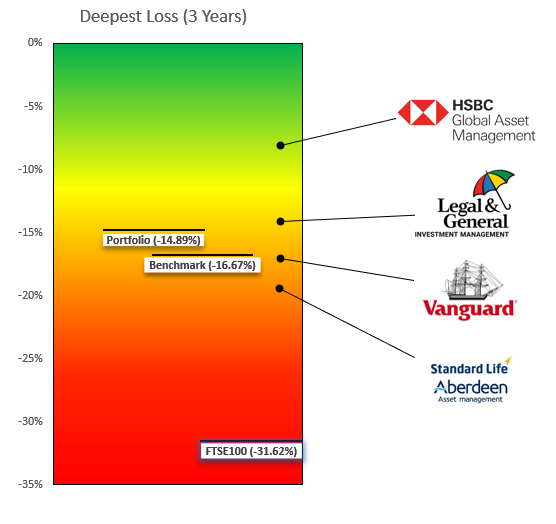

Maximum Loss

Maximum loss is a measure of the greatest possible loss from the highest peak to the lowest point within a given timescale.

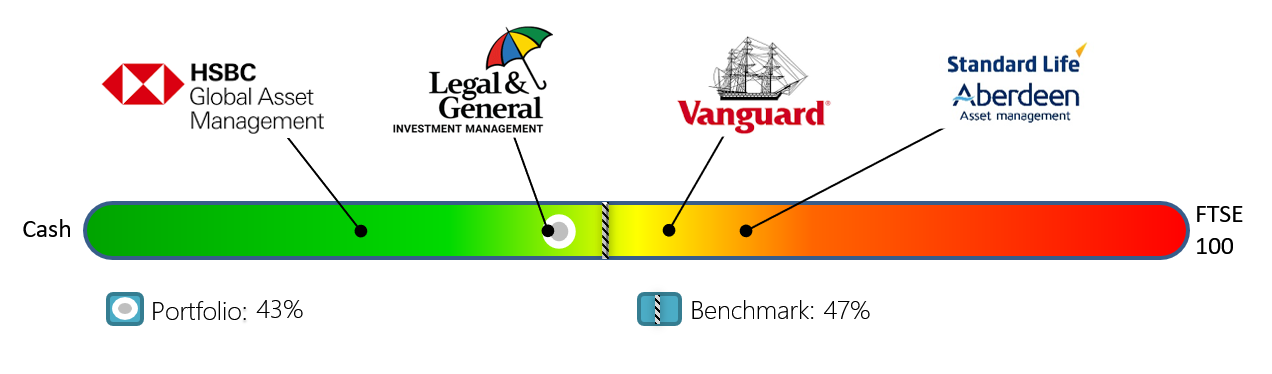

Volatility

Volatility is the degree to which the fund moves up or down on a day to day basis. The following chart demonstrates the portfolio risk compared to the benchmark (AKA the average cautious fund) over a three year period. Cash is at the lowest end of the scale and set the FTSE 100 at the far end of the scale for relative comparison.