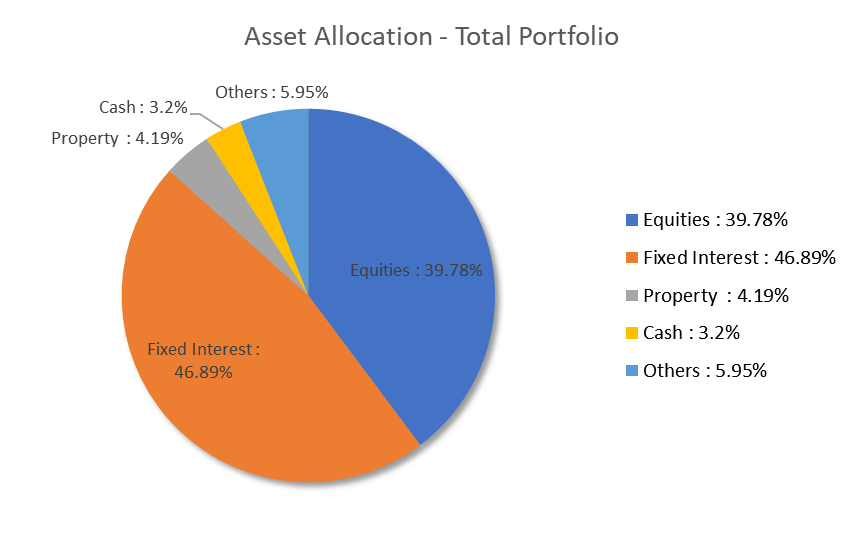

Investment Philosophy – Current Asset Allocation (Cautious Portfolio)

The following charts show the breakdown between the asset classes within our cautious portfolio.

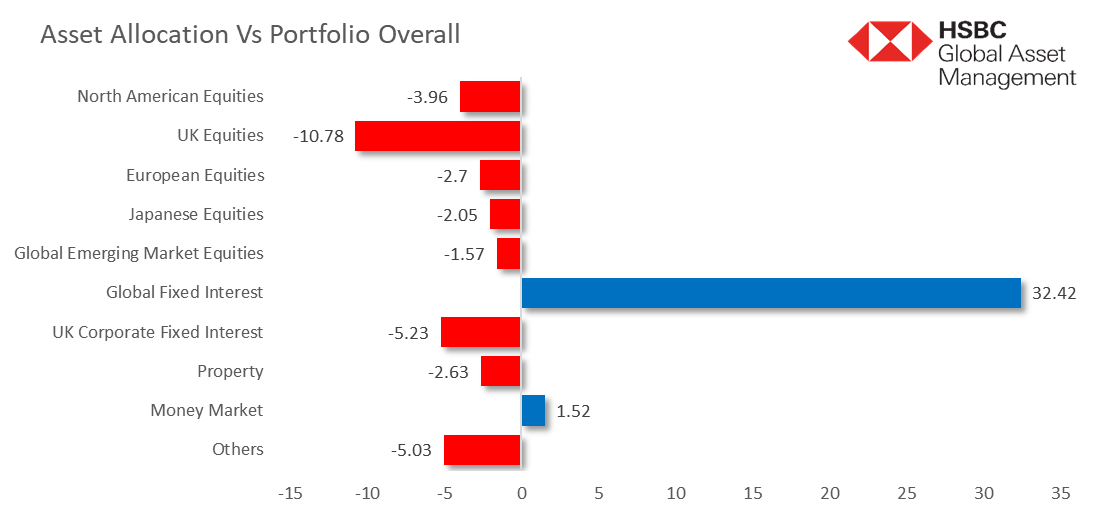

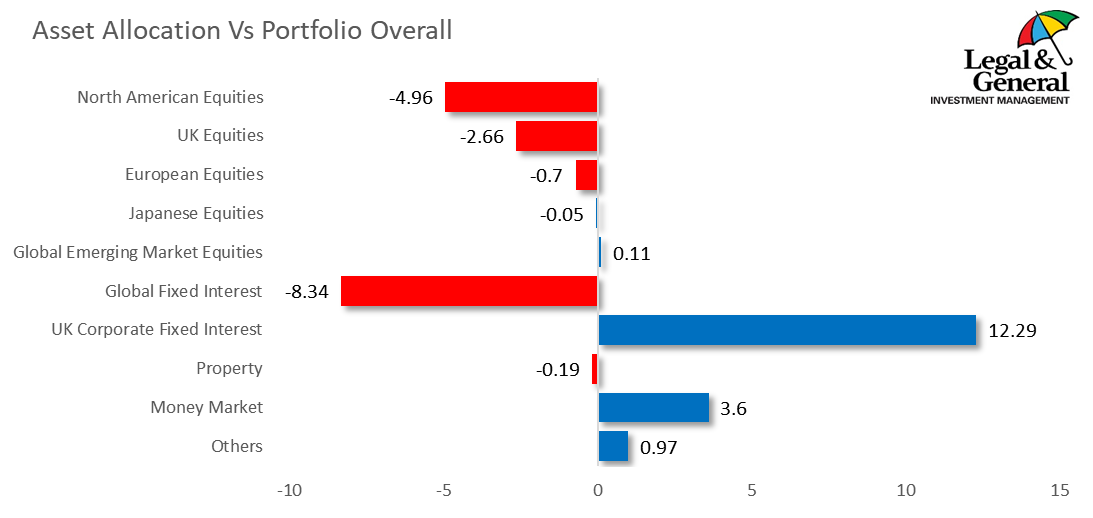

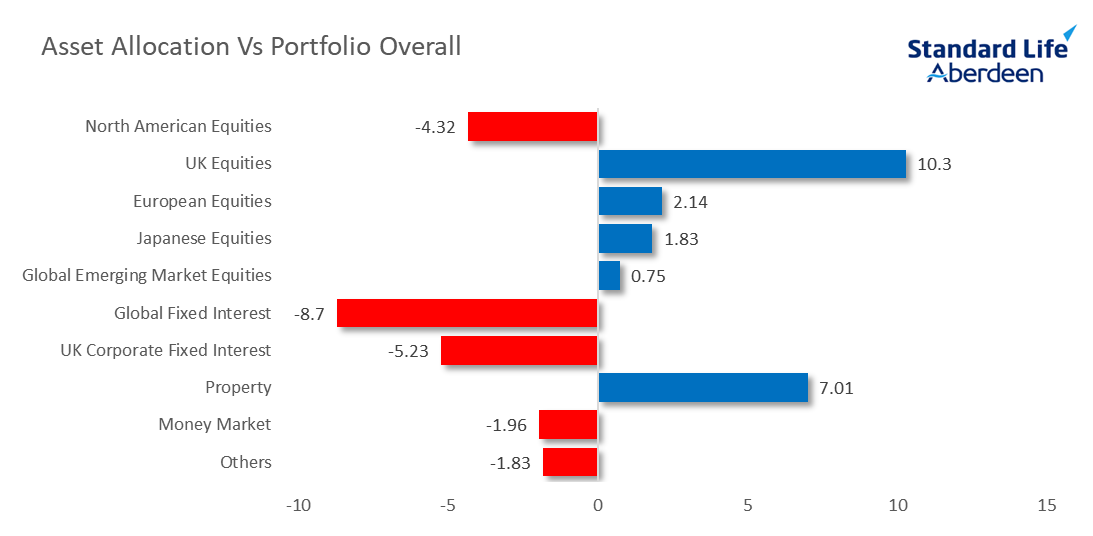

Asset Allocation – Individual Funds

The following charts show the asset allocation of each fund relative to the portfolio as a whole. This highlights the different “house” views which, in some areas, are in opposition to the other funds. Standard Life & Vanguard put more weight in equities while HSBC and Legal & General take a more cautious approach. The aim of having such differing approaches is to reduce the impact of a “black swan” event. When markets experience turbulence at a level that challenges the fundamental value of investments, the probability of errors in judgement increase. Combining managers who have different views on the optimal strategy in today’s markets should reduce the chance of them collectively falling into the same trap in a crisis. Although the strategies are different, each fund has managed to outperform the benchmark on a “risk adjusted” basis in their own right.