Many academic papers have been written about the impact of asset allocation on investment returns and risk. The vast majority conclude that it is more influential than any other factor and therefore asset allocation is at the heart of our investment philosophy.

“Ask five economists and you’ll get five different answers – six if one went to Harvard.”

Edgar Fiedler (Assistant Secretary of the US Treasury for Economic Policy, 1971 – 1975) Traditional portfolio construction involves a predetermined “model allocation” suitable for a client’s attitude to risk. But as

Edgar Fiedler points out, there many opinions on the economic outlook and therefore many opinions the most appropriate investment mix. If you choose only one model, what if it’s wrong? What happens if the world changes overnight and a recalibration needs to take place? It takes a considerable level of skilled analysts to monitor and interpret the real-time data as well as making the necessary adjustments to the model. Multi-Asset funds provide the ideal solution to the problem as they invest according to their own model and have a team of dedicated professionals who can make the necessary changes in short order.

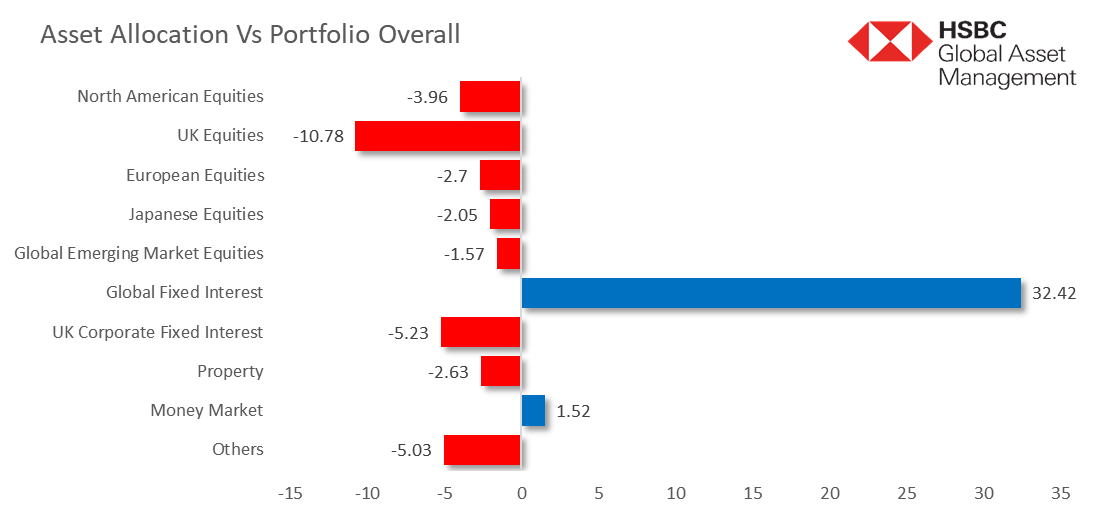

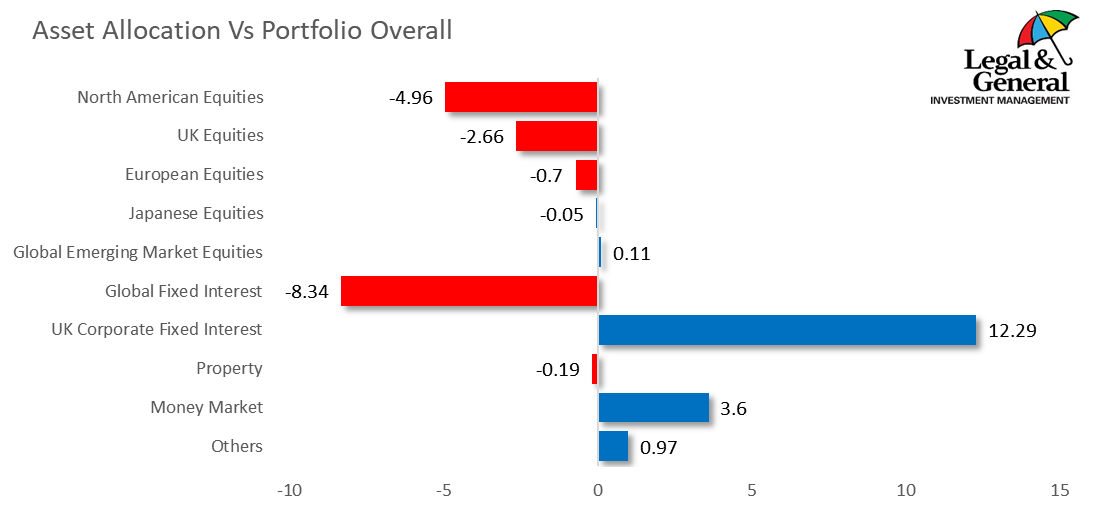

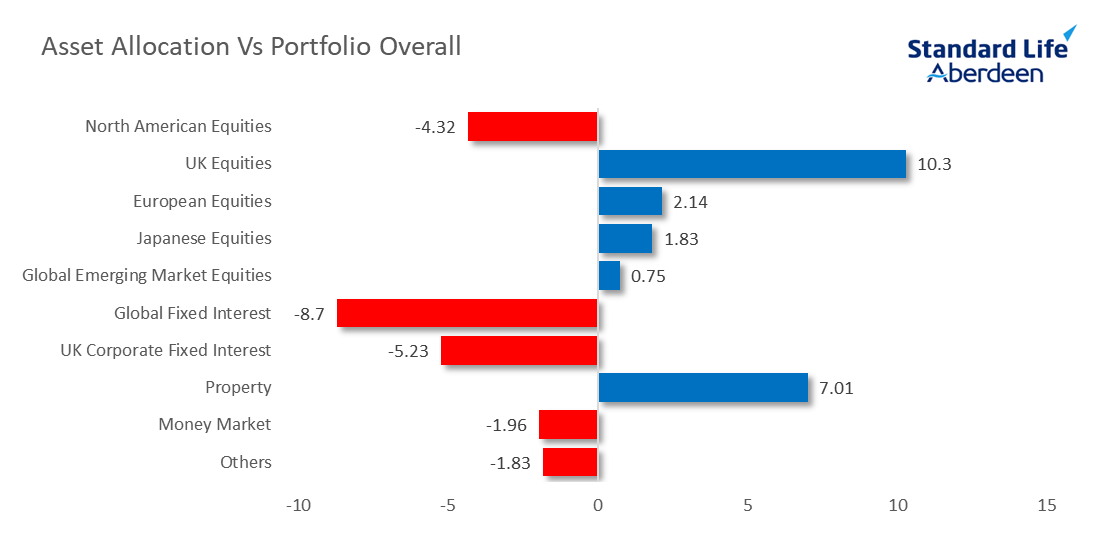

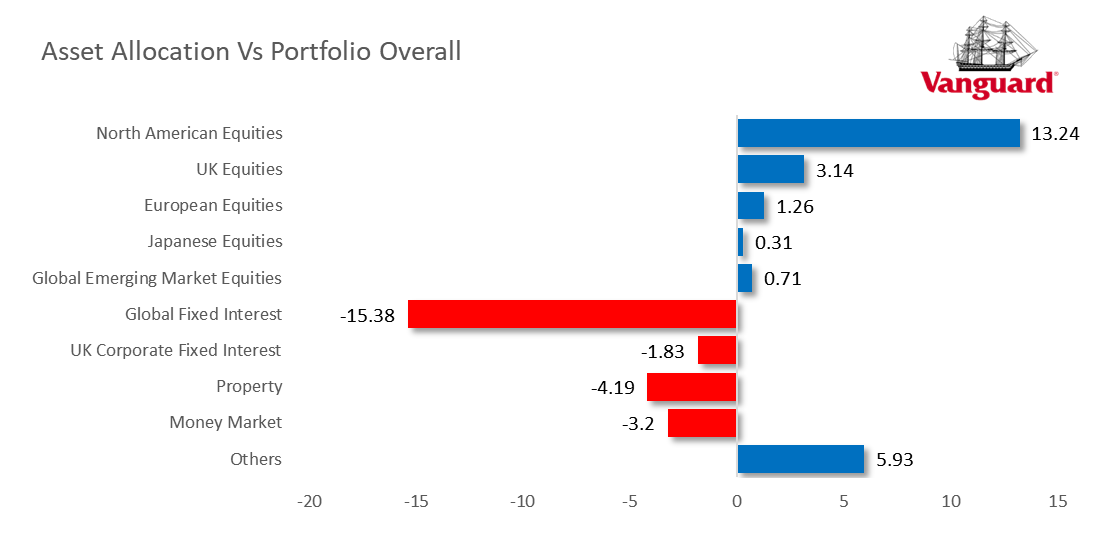

Having a diverse range of opinions within a team will help form an informed concensus. However, investing in a range of multi-asset funds from different companies ensures against the “echo chamber” effect or from overly influential individuals within the company. It also taps into the knowledge and experiance of a far greater range of investment professionals, analysts, strategists and economists. The aim is to consistently generate slightly higher than average returns in the good times and mitigate the losses more effectively than average through the bad times. The following charts demonstrate the disparity of positions held by the four funds in our portfolio which have broadly similar targets. Standard Life & Vanguard put more weight in equities while HSBC and Legal & General take a more cautious approach. When markets experience turbulence that challenges the fundamental value of investments, the probability of errors in judgement increase. Selecting managers who have differing views of the optimal strategy in today’s markets should reduce the chance of collectively making the same mistakes in a crisis. Although every strategy is different each fund has managed to outperform the benchmark on a “risk adjusted” basis.

Fund Level Asset Allocation Breakdown

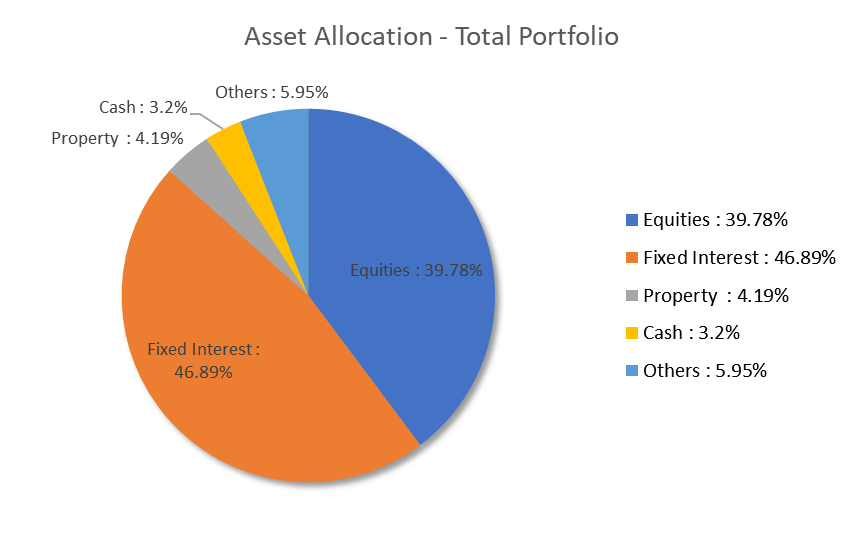

Portfolio Overall Asset Allocation

Data from FE fundinfo 2020 as at 17/07/2020.

Asset Allocation Strategies

It’s important to find the right long term risk/reward grounding based on solid principles and analysis. However, many managers see inherent short term risks & opportunities caused by extreme market conditions which they believe they can take advantage of while they exist. Of course, this carries the risk of manager error so we select a blend of funds that range between a fairly static model to the more intrepid tactical funds.

Asset Allocation Key terms

-

- Strategic – Making investment decisions, with a longer term view (10-15 years+) and placing little emphasis on the immediate market turbulence.

- Tactical – Making investment changes with a short term view (1 month+) of anticipated returns.

|

Strategic Model : In-house Tactical Overlay : Yes (Limited) | The strategic asset allocation model is set to maximise the return for a given risk budget, with limited tactical asset allocation used to express more short-term market views. |

|

Strategic Model : In-house Tactical Overlay : Yes | A long term asset allocation (LTAA) acts as a reference point and initial starting point from which the Dynamic Asset Allocation (DAA) is applied to create the target allocation. The DAA will consider a medium term investment horizon, typically a one to five year period, rather than tactical asset allocation (TAA), which can tend to focus on a short term investment horizon, such as a few weeks or months. |

|

Strategic Model : Moody’s Analytics Tactical Overlay : Yes | Standard life’s Strategic Asset Allocation Committee work together with Moody’s Analytics to decide a suitable long term model within certain risk parameters. Tactical positions are limited to +/- 5% of the benchmark within each asset class. This same limit applies to any variation in the splits of growth and defensive assets with defensive assets being cash and fixed income and the remainder classified as growth assets. |

|

Strategic Model : In-house Tactical Overlay : No | The overall investment process behind the Life Strategy funds is relatively straightforward. Each fund in the range has a pre-determined strategic asset allocation split between equities and fixed income with an additional set of weightings at sub-regional and sub-asset class level.There is no tactical asset allocation overlay. |