Re-emerging

Although we are well through the first phase of the pandemic and there is relative calm we need to be prepared for the next challenge. Even if there is no second wave of infection in the autumn it will be a time when it will be much easier to see the full economic impact of the worldwide lockdown. The UK Treasury states that more than 1 in 4 workers are on furlough at this time. The OECD is predicting a fall of 6% in global growth this year which may not sound a lot but many countries with expanding populations need strong growth just to stand still. We are now beginning to get more clarity on the scale of the job losses which will come into sharp relief when the furlough scheme is phased out in autumn. Even with all the government help which has been provided it will not be possible to save the companies who were struggling before the crisis began.

Signs of hope

On a positive note. Pictet, a large fund manager with close contact with the pharmaceutical industry, is reporting an 80% chance of creating an effective vaccine by the end of the year. Clearly such a development would be transformational for society and also for the economy and explains part of the stock market recovery. Nevertheless, every national economy has sustained serious damage and this will be reflected in elevated unemployment. However, governments globally are making strenuous efforts to support their leading companies by means of massive loans and in some cases actually taking a share of ownership in the businesses. There is a level of commitment around the world to provide financial support for business which I have never seen before.

Additionally, investors can take a level of comfort from the fact that the £350bn rescue package has been dwarfed by the £650bn quantitative easing plans announced in March. This has direct and indirect benefits for all investments without contributing significantly to retail price inflation. This is another significant factor in explaining the steep climbs in the stock market against the troubling economic data.

Rescued banks to the rescue

One positive development is the very constructive part being played by the banks. They have been able to lend record breaking amounts of money to business in a very short period. They have deferred collecting interest from customers and are not pressing their customers for money as they did during the banking crisis. Last time we had a full blown crisis it was caused by the banks but now they are a significant part of the solution. All of the familiar high street banks are financially strong and there is no question about their ongoing solvency. Strangely the banking system is one of the most stable parts of the economy at this time. When we come through this crisis credit will be given to them for the vital part they played in keeping money flowing through the economy. Your money is much more safe with the banks than it was 12 years ago during the last period of extreme volatility.

Portfolio Update

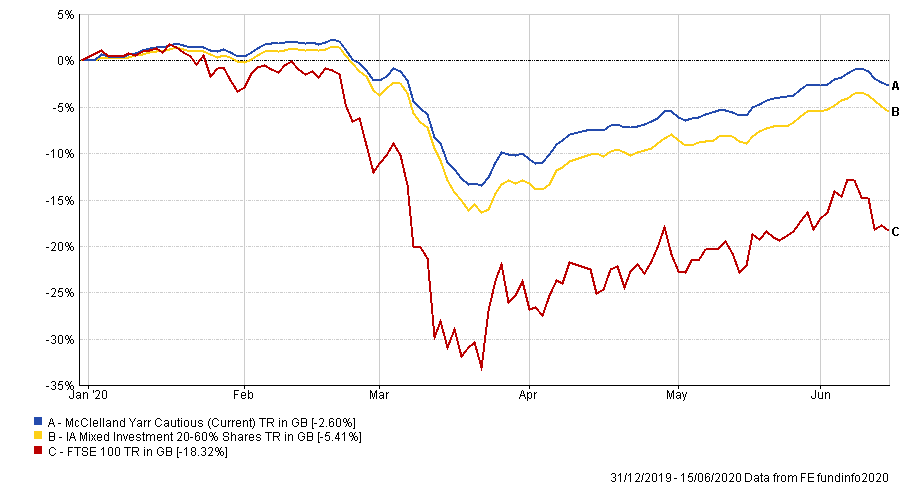

I thought it might be informative and reassuring to report the latest performance data compared to the benchmark and FTSE 100. I will also set out a high level view of our cautious portfolio philosophy to explain how we reduce risk and increase consistency of returns.

Portfolio Construction

“Ask five economists and you’ll get five different answers – six if one went to Harvard.”

Traditional portfolio construction involves a predetermined “model allocation” suitable for a client’s attitude to risk. But as Edgar Fiedler points out, there many opinions on the economic outlook and therefore many opinions the most appropriate investment mix. If you choose only one model, what if it’s wrong? What happens if the world changes over a very short period of time and a recalibration needs to take place? It takes a considerable level of skilled analysts to monitor and interpret the real-time data as well as making the necessary adjustments to the model.

Multi-Asset funds provide the ideal solution to the problem as they invest according to their own model and have a team of dedicated professionals who can make the necessary changes in short order. Many advisers now research and select a multi asset fund for clients with smaller portfolios to ensure they continue to receive a quality investment service. However this does not address Edgar’s central point which is why we believe the best approach is to have a carefully selected spread of multi asset funds. Each one being selected on the basis of risk, performance, cost and, most importantly, offering an approach to asset allocation which differs from the others in the portfolio. We have found that this has consistently generated slightly higher than average returns in the good times and mitigated the losses slightly better than average through the bad times.

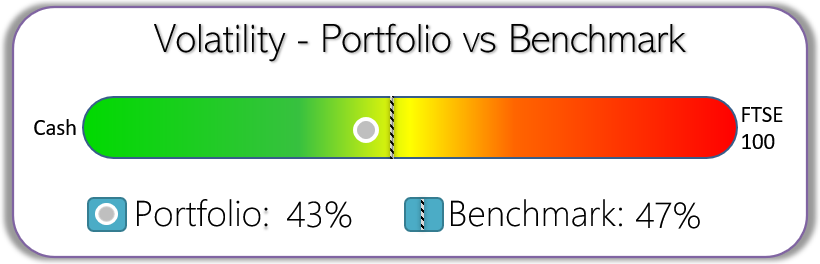

Risk – Volatility

|

Volatility is the day to day ups and downs (or sensitivity) of the fund.The following chart demonstrates the portfolio risk compared to the benchmark (AKA the average cautious fund) over a three year period. Cash is at the lowest end of the scale and set the FTSE 100 at the far end of the scale for relative comparison.

|

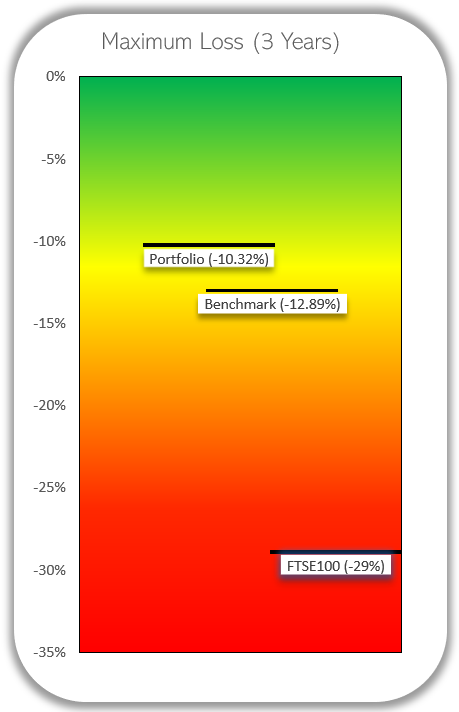

Risk – Maximum Loss

Performance

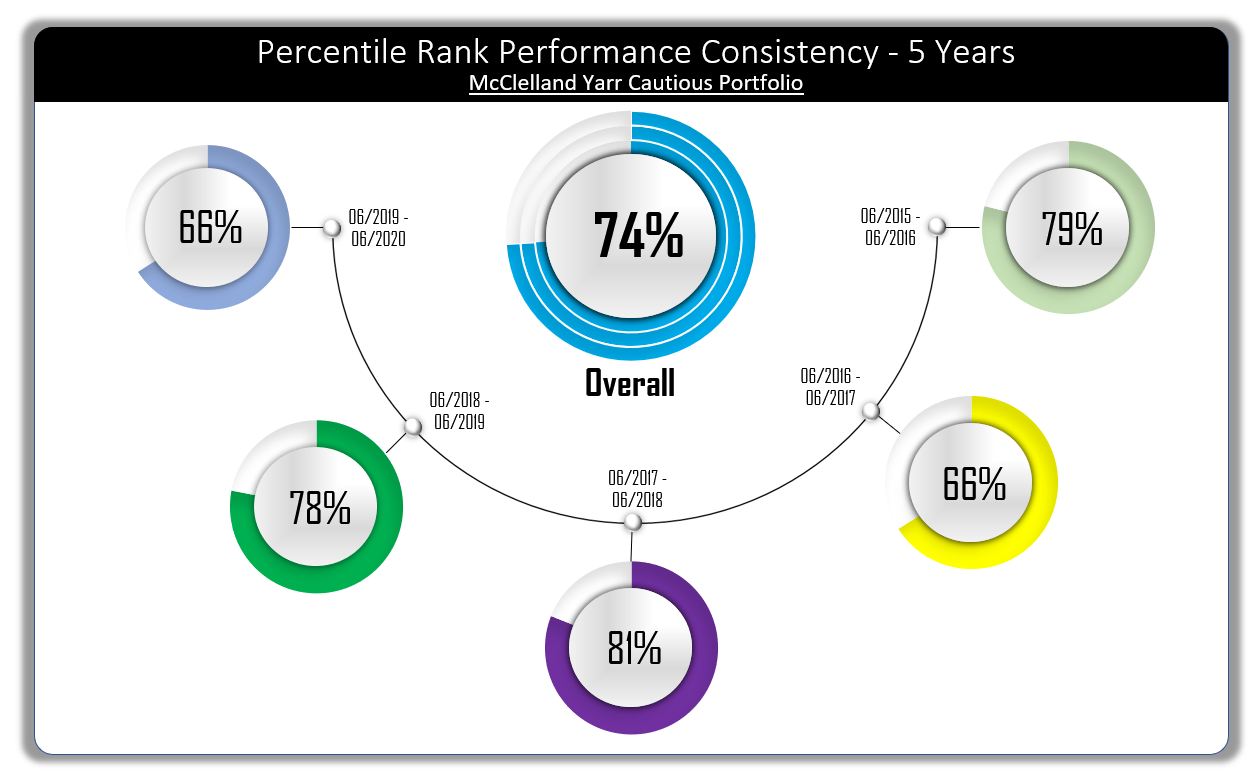

The following graphic shows the performance rank of our portfolio for each of the past five discrete annual periods compared to all other funds within the benchmark.

Although there are years when there have been surprises to the upside, the performance has consistently been slightly better than average. |

Consistency

Consistency is king because losses sustained are hard to recover lost ground without taking excessive risk. By the same token, funds that aim to perform at the highest levels have necessarily taken on risks that are unreliable.

Cost

|

Although you can sacrifice too much by letting cost be the sole decision making factor, it is still has a considerable impact and is one we try to drive out wherever possible.  |

Opportunities

The cost of the support measures being incurred by the government will need to be met by increased taxation. It is therefore a good time to prepare for that by using up whatever tax benefits are available. The most obvious one is the annual ISA allowance of £20,000. This is a very generous sum of money and we consider it to be permanent like tax relief on pension contributions. It is hard to see any change to tax money already in an ISA but the ability to contribute at the present level in future should not be taken for granted. The pandemic will give the Chancellor an opportunity to make big changes which would have been problematic in normal times.

Peter

Director